HPS Sells 2025 School Building & Site Bonds - Series II

May 6, 2025

Jessica Mathews / news@whmi.com

Howell Public Schools has successfully sold its second series of school building and site bonds.

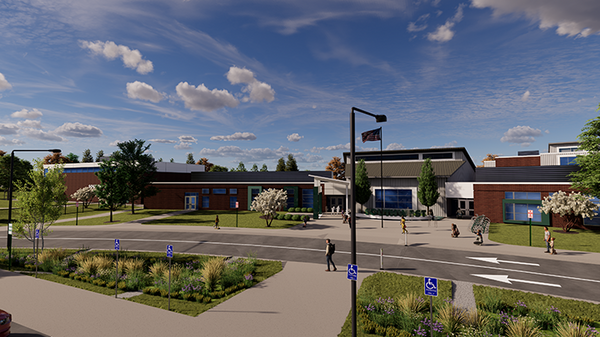

The funds will be used for improvements throughout the district, including the replacement of the Northwest and Southwest elementary schools and an addition to and renovation of Highlander Way Middle School.

The 2025 Bonds are the second of three series from the "Our Kids, Our Community, Our Future" Bond proposal, which was approved by voters in November 2023.

The 2025 Bonds were sold Tuesday, April 29th at a tax-exempt fixed interest rate of 4.36%, with a final maturity of 2045.

On the day of pricing, demand was said to be strong with 58 investment firms placing orders totaling more than 11 times the available bond amount. That strong demand resulted in a better-than-expected interest rate, ensuring taxpayers will benefit from low borrowing costs while maximizing the value of the bond funds for district improvements.

Superintendent Erin MacGregor said “The successful sale of the 2025 Bonds is a critical step in implementing the 'Our Kids, Our Community, Our Future' Bond proposal. Thanks to the support of our community and the strong financial management of the Board of Education, we were able to secure a favorable interest rate, saving taxpayers money while funding essential improvements.”

In preparation for the bond sale, the district requested a credit evaluation from S&P Global, receiving an underlying bond rating of "A+" for the 2025 Bonds. S&P Global cited the district’s stable economic base, realistic budgeting, experienced management team, and sufficient reserves as the basis for the rating.

The 2025 Bonds also received a “AA” rating due to the district’s participation in the Michigan School Bond Qualification and Loan Program.

The district's financing was structured and coordinated by PFM Financial Advisors LLC, with Thrun Law Firm, P.C. serving as bond counsel. J.P. Morgan Securities LLC acted as the managing underwriter for the 2025 Bonds.